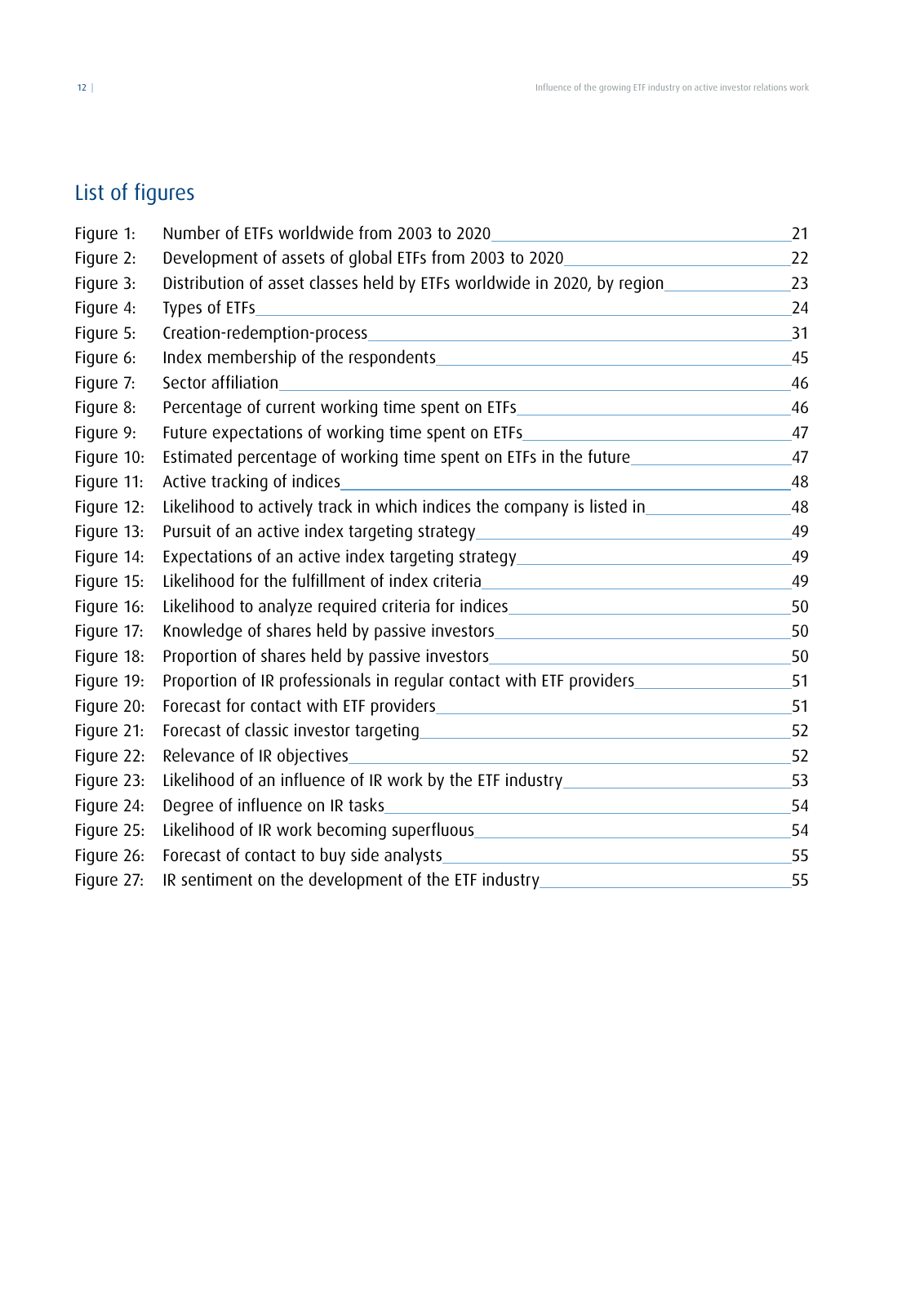

Influence of the growing ETF industry on active investor relations work12 List of figures Figure 1 Number of ETFs worldwide from 2003 to 2020 21 Figure 2 Development of assets of global ETFs from 2003 to 2020 22 Figure 3 Distribution of asset classes held by ETFs worldwide in 2020 by region 23 Figure 4 Types of ETFs 24 Figure 5 Creation redemption process 31 Figure 6 Index membership of the respondents 45 Figure 7 Sector affiliation 46 Figure 8 Percentage of current working time spent on ETFs 46 Figure 9 Future expectations of working time spent on ETFs 47 Figure 10 Estimated percentage of working time spent on ETFs in the future 47 Figure 11 Active tracking of indices 48 Figure 12 Likelihood to actively track in which indices the company is listed in 48 Figure 13 Pursuit of an active index targeting strategy 49 Figure 14 Expectations of an active index targeting strategy 49 Figure 15 Likelihood for the fulfillment of index criteria 49 Figure 16 Likelihood to analyze required criteria for indices 50 Figure 17 Knowledge of shares held by passive investors 50 Figure 18 Proportion of shares held by passive investors 50 Figure 19 Proportion of IR professionals in regular contact with ETF providers 51 Figure 20 Forecast for contact with ETF providers 51 Figure 21 Forecast of classic investor targeting 52 Figure 22 Relevance of IR objectives 52 Figure 23 Likelihood of an influence of IR work by the ETF industry 53 Figure 24 Degree of influence on IR tasks 54 Figure 25 Likelihood of IR work becoming superfluous 54 Figure 26 Forecast of contact to buy side analysts 55 Figure 27 IR sentiment on the development of the ETF industry 55

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.