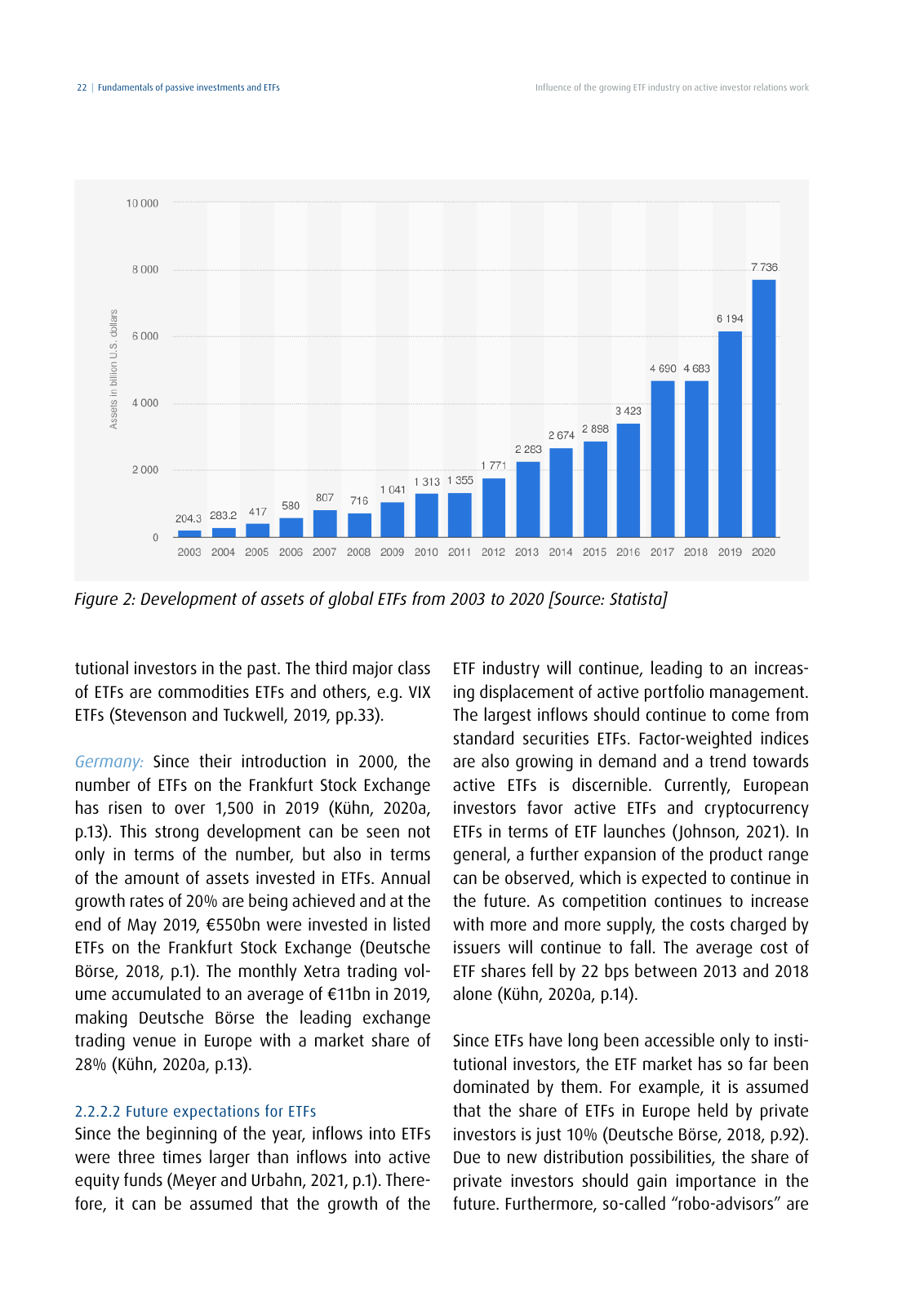

Influence of the growing ETF industry on active investor relations work22 Fundamentals of passive investments and ETFs tutional investors in the past The third major class of ETFs are commodities ETFs and others e g VIX ETFs Stevenson and Tuckwell 2019 pp 33 Germany Since their introduction in 2000 the number of ETFs on the Frankfurt Stock Exchange has risen to over 1 500 in 2019 Kühn 2020a p 13 This strong development can be seen not only in terms of the number but also in terms of the amount of assets invested in ETFs Annual growth rates of 20 are being achieved and at the end of May 2019 550bn were invested in listed ETFs on the Frankfurt Stock Exchange Deutsche Börse 2018 p 1 The monthly Xetra trading vol ume accumulated to an average of 11bn in 2019 making Deutsche Börse the leading exchange trading venue in Europe with a market share of 28 Kühn 2020a p 13 2 2 2 2 Future expectations for ETFs Since the beginning of the year inflows into ETFs were three times larger than inflows into active equity funds Meyer and Urbahn 2021 p 1 There fore it can be assumed that the growth of the ETF industry will continue leading to an increas ing displacement of active portfolio management The largest inflows should continue to come from standard securities ETFs Factor weighted indices are also growing in demand and a trend towards active ETFs is discernible Currently European investors favor active ETFs and cryptocurrency ETFs in terms of ETF launches Johnson 2021 In general a further expansion of the product range can be observed which is expected to continue in the future As competition continues to increase with more and more supply the costs charged by issuers will continue to fall The average cost of ETF shares fell by 22 bps between 2013 and 2018 alone Kühn 2020a p 14 Since ETFs have long been accessible only to insti tutional investors the ETF market has so far been dominated by them For example it is assumed that the share of ETFs in Europe held by private investors is just 10 Deutsche Börse 2018 p 92 Due to new distribution possibilities the share of private investors should gain importance in the future Furthermore so called robo advisors are Figure 2 Development of assets of global ETFs from 2003 to 2020 Source Statista

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.