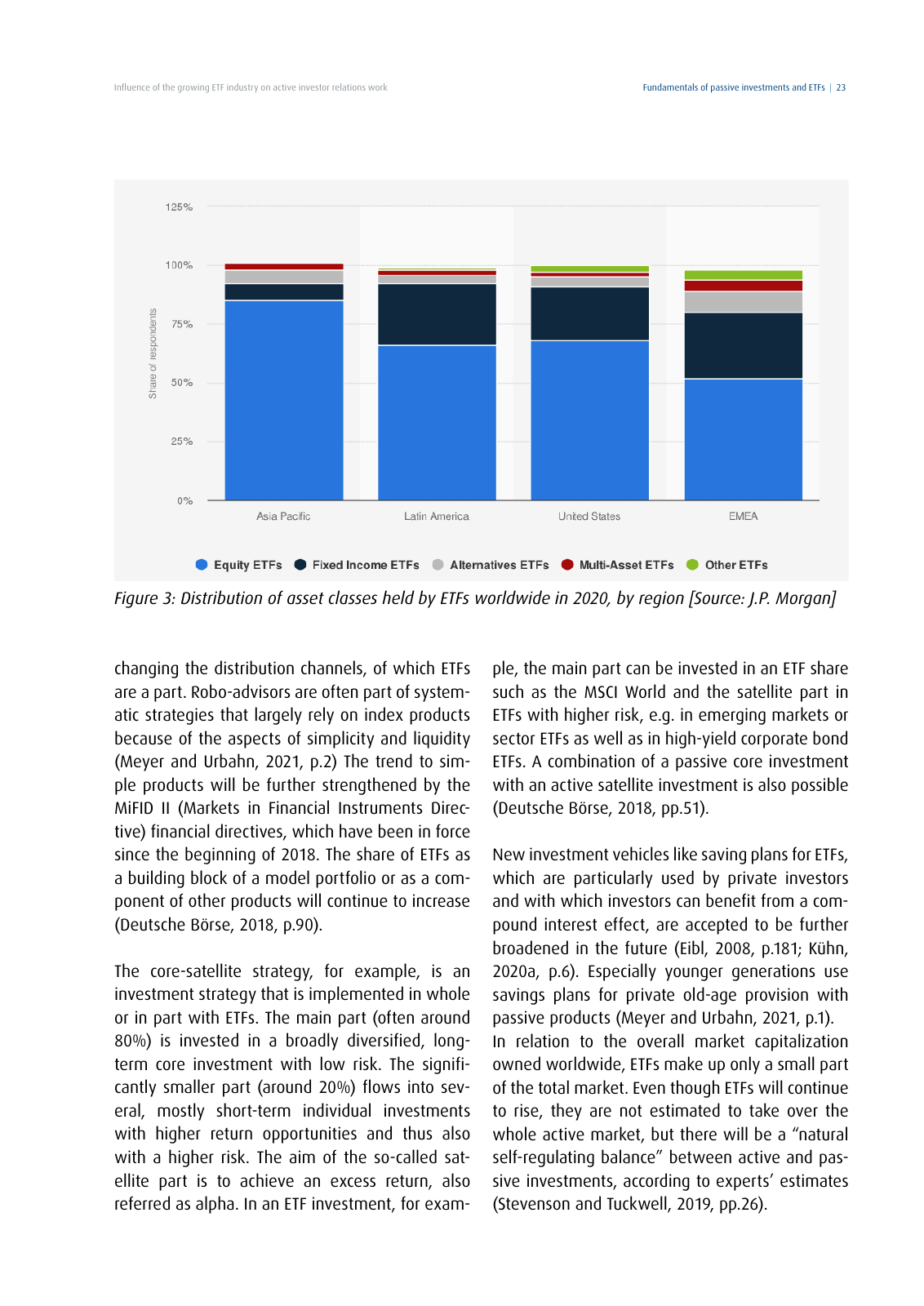

Influence of the growing ETF industry on active investor relations work 23Fundamentals of passive investments and ETFs changing the distribution channels of which ETFs are a part Robo advisors are often part of system atic strategies that largely rely on index products because of the aspects of simplicity and liquidity Meyer and Urbahn 2021 p 2 The trend to sim ple products will be further strengthened by the MiFID II Markets in Financial Instruments Direc tive financial directives which have been in force since the beginning of 2018 The share of ETFs as a building block of a model portfolio or as a com ponent of other products will continue to increase Deutsche Börse 2018 p 90 The core satellite strategy for example is an investment strategy that is implemented in whole or in part with ETFs The main part often around 80 is invested in a broadly diversified long term core investment with low risk The signifi cantly smaller part around 20 flows into sev eral mostly short term individual investments with higher return opportunities and thus also with a higher risk The aim of the so called sat ellite part is to achieve an excess return also referred as alpha In an ETF investment for exam ple the main part can be invested in an ETF share such as the MSCI World and the satellite part in ETFs with higher risk e g in emerging markets or sector ETFs as well as in high yield corporate bond ETFs A combination of a passive core investment with an active satellite investment is also possible Deutsche Börse 2018 pp 51 New investment vehicles like saving plans for ETFs which are particularly used by private investors and with which investors can benefit from a com pound interest effect are accepted to be further broadened in the future Eibl 2008 p 181 Kühn 2020a p 6 Especially younger generations use savings plans for private old age provision with passive products Meyer and Urbahn 2021 p 1 In relation to the overall market capitalization owned worldwide ETFs make up only a small part of the total market Even though ETFs will continue to rise they are not estimated to take over the whole active market but there will be a natural self regulating balance between active and pas sive investments according to experts estimates Stevenson and Tuckwell 2019 pp 26 Figure 3 Distribution of asset classes held by ETFs worldwide in 2020 by region Source J P Morgan

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.