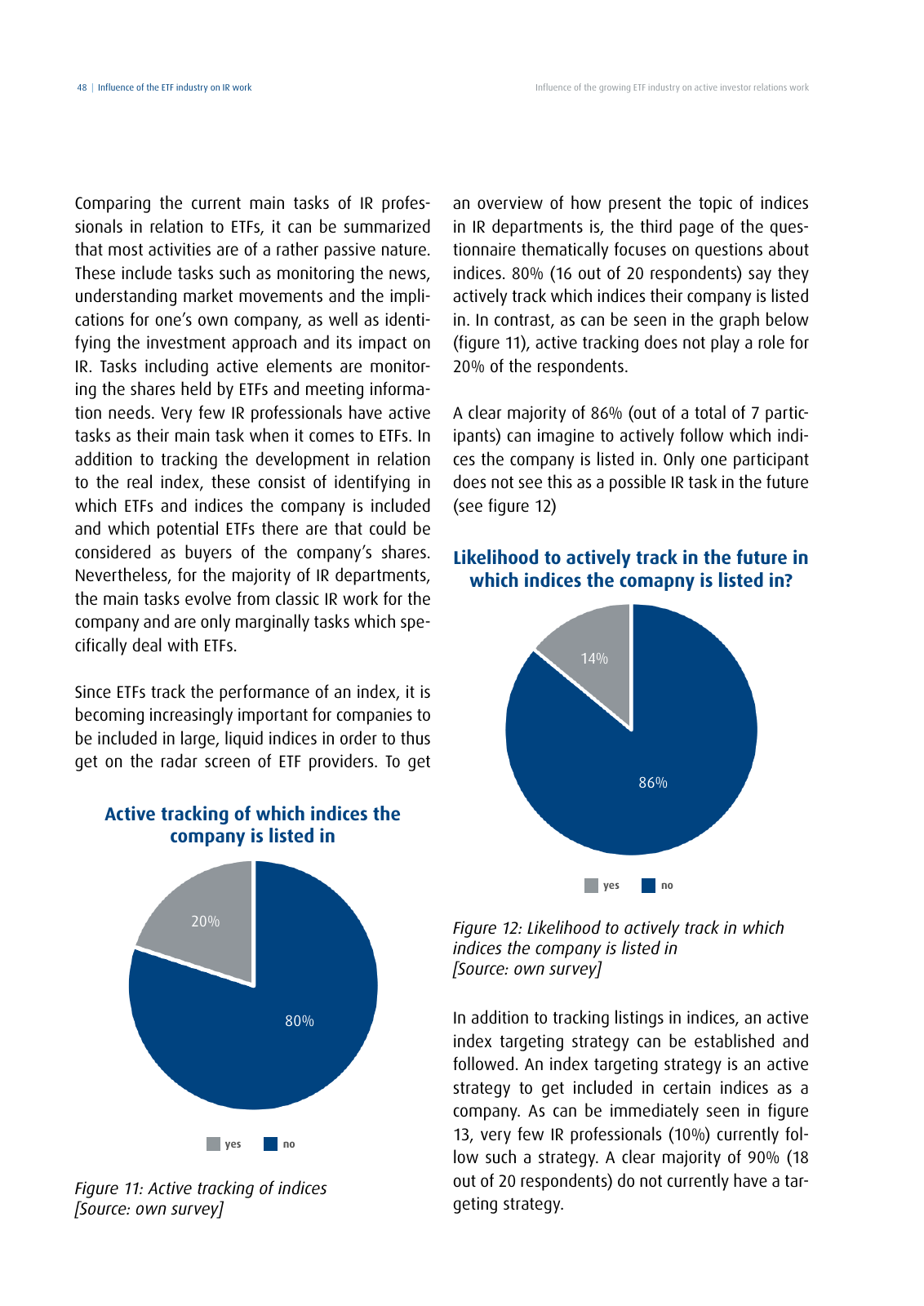

Influence of the growing ETF industry on active investor relations work48 Influence of the ETF industry on IR work Comparing the current main tasks of IR profes sionals in relation to ETFs it can be summarized that most activities are of a rather passive nature These include tasks such as monitoring the news understanding market movements and the impli cations for one s own company as well as identi fying the investment approach and its impact on IR Tasks including active elements are monitor ing the shares held by ETFs and meeting informa tion needs Very few IR professionals have active tasks as their main task when it comes to ETFs In addition to tracking the development in relation to the real index these consist of identifying in which ETFs and indices the company is included and which potential ETFs there are that could be considered as buyers of the company s shares Nevertheless for the majority of IR departments the main tasks evolve from classic IR work for the company and are only marginally tasks which spe cifically deal with ETFs Since ETFs track the performance of an index it is becoming increasingly important for companies to be included in large liquid indices in order to thus get on the radar screen of ETF providers To get an overview of how present the topic of indices in IR departments is the third page of the ques tionnaire thematically focuses on questions about indices 80 16 out of 20 respondents say they actively track which indices their company is listed in In contrast as can be seen in the graph below figure 11 active tracking does not play a role for 20 of the respondents A clear majority of 86 out of a total of 7 partic ipants can imagine to actively follow which indi ces the company is listed in Only one participant does not see this as a possible IR task in the future see figure 12 In addition to tracking listings in indices an active index targeting strategy can be established and followed An index targeting strategy is an active strategy to get included in certain indices as a company As can be immediately seen in figure 13 very few IR professionals 10 currently fol low such a strategy A clear majority of 90 18 out of 20 respondents do not currently have a tar geting strategy Figure 12 Likelihood to actively track in which indices the company is listed in Source own survey Likelihood to actively track in the future in which indices the comapny is listed in yes no Figure 11 Active tracking of indices Source own survey Active tracking of which indices the company is listed in yes no 14 20 80 86

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.